Learn: Buying Diamonds > Lab Grown Diamonds

Introduction

De Beers Lightbox LGD’S

What is a Synthetic diamond?

How Low Can LGD Prices Go?

Will LGD’S Make Natural Diamonds Worthless?

Identification

HPHT & CVD Diamonds

Industrial Diamonds

What’s In A Name?

LGD Pricing

Lab Grown Myths & Facts

1. LGD’s are real diamonds:

True, but so are all the other synthetic gems. Ruby and sapphire were first made in 1883 and cost a few dollars a carat.

2. Jewelers can’t tell LGD’s from natural diamonds:

Professional jewelers and gemologists easily screen LGD’s from natural with inexpensive instruments.

3. LGD’s are new and exciting:

The first LGD’s were made in the 1950’s

4. If I wait will LGD’s get cheaper:

Yes.

Read on for all the answers

What is a Synthetic diamond?

Gemologists call lab grown diamonds (LGD) synthetics. This is considered a confusing term by the US Federal Trade Commission (FTC), but from a gemologist’s point of view a synthetic is one up on a fake or imitation gem. A synthetic diamond is a real diamond made by people. Imitation diamonds and faked improvements to natural stones date back thousands of years. Real synthetic diamonds were first developed by ASEA and GE in the 1950’s. Industrial abrasive diamonds have been made this way ever since using High Pressure, High Temperature presses (HPHT). It has only been in the past decade that colourless gem diamonds have been a commercially viable product.

The place for LGD’s is to replace low quality diamonds in jewelry sold in chain stores and poorer nations and communities. Media pronounced the death of diamonds when Cubic Zirconia’s (CZ) hit the market in the 1970’s. If anything CZ’s encouraged more consumers to aspire for bigger diamonds. As far as engagement rings go, it is unlikely LGD’s will take more than a small share of that market. For those people who do not like the economic symbolism of diamonds, LGD’s may be a new market.

Will synthetic diamonds hold their value?

Will LGD’s make natural diamonds worthless?

It seems obvious that LGD’s will make natural diamonds worth less money. However, consider the fact that more than half of the value of the diamonds from any mine are low quality gems and not especially valuable. These make up more than half the world’s diamonds by value and are mostly sold in chain stores. If LGD’s replace most of those diamonds, then many mines will be retired early. Less funding will be available to prospectors to find new diamond mines.

In that scenario high value expensive and rare are diamonds will become even rarer and more expensive.

Which diamond would you like Sir? This smaller natural diamond or the bigger LGD?

HPHT & CVD Diamonds

There are two methods of manufacture.

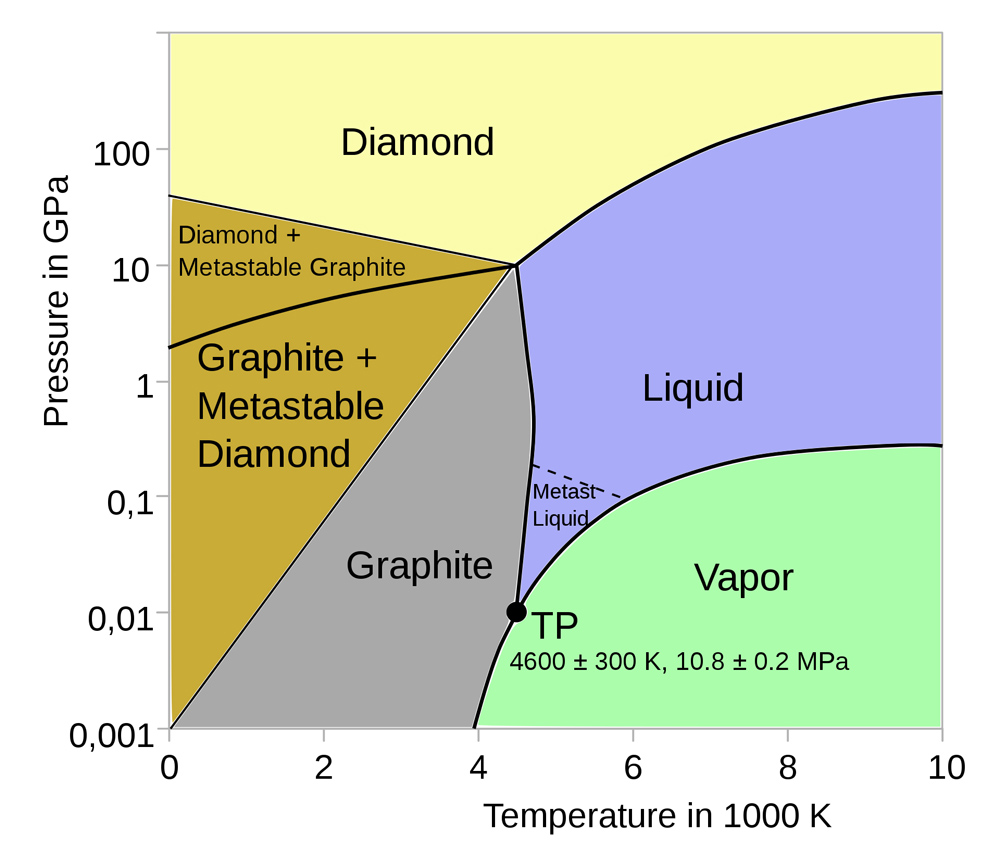

In the mid 1950’s GE and ASES companies both built high-pressure, high-temperature (HPHT) presses and methods to synthesize diamonds in a process similar to the geologic temperatures and pressures that form diamonds in the earth.

Chemical vapor deposition (CVD) is a more recent process. A vacuum chamber is filled with carbon gas and crystallizes on a diamond seed. This method uses lower temperatures and pressures than HPHT.

HPHT

- A diamond seed and carbon is placed in a huge press with a metal catalyst (that is magnetic)

- Heat and pressure are applied

- The metal melts and the carbon dissolves

- Carbon precipitates on the diamond seed crystal, just like in a salt chemistry experiment.

Graphite is dissolved in a molten flux of metals such as iron, nickel or cobalt, which lowers the temperature and pressure needed for diamond growth. This lower temperature and pressures resulting in diamond crystals that are dodecahedral rather than octahedral as natural diamonds are that form under higher pressure and temperatures. Because the crystals are different, their internal growth patterns differ dramatically and this assists in identification of synthetic diamond crystals. They are also often able to be picked up with a strong magnet as any inclusions are metallic.

By growing over the top of a previously grown diamond larger than 10 carats stones have been created.

Image source: Wikipedia

Image source:

CVD

CVD diamonds are grown from a hydrocarbon gas like methane under increased pressure and temperature in a vacuum chamber.

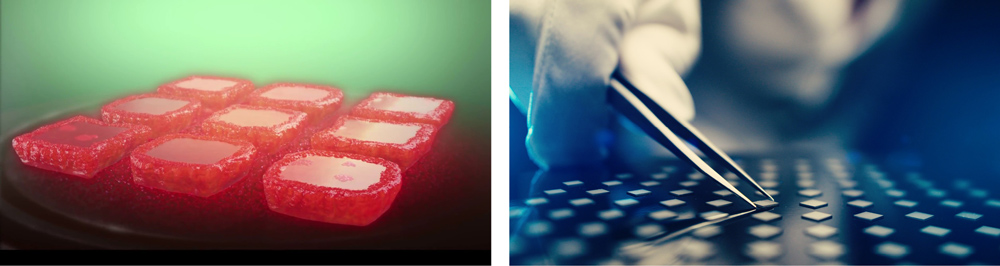

- Flat diamond seed crystals are vacuum chambers filled with carbon gases

- The chamber is heated to about 900-1200°C

- A microwave or laser beam creates a carbon plasma rain

- Diamonds may need to be removed and the surfaces repolished and placed back in which can result in grain lines that reduce transparency

- growth can take a few weeks

- After the synthetic diamond crystals are removed, they are ready to be cut and polished into the final product.

Several crystals can be grown at once and the crystals grow upwards from the tabular seed. Black graphite forms around the edges and is cut away. CVD colorless diamonds are usually brown and are bleached by HPHT and heated annealing.

What’s in a name?

Diamonds are not grown in labs. They are grown in big factories but the power of marketing has made LGD stick. As a new product LGD’s are attracting venture capital funding and achieving generous profit margins. A lot of money is being spent on press releases promoting benefits that have little or no basis in fact. Marketers have produced a war of words. Natural diamonds are referred to as mined diamonds, earth mined diamonds, blood diamonds and so on. Some companies are claiming they extract their carbon from the atmosphere. There is a real need for valid third party assessment of greenwashing claims. The US FTC has warned several companies about making unsubstantiated claims.

LGD’s are said to be better for the environment and reduce global warming. The amount of power consumed to grow a synthetic diamond is huge. The vast majority are produced in China and India with power supplied from fossil fuels. American companies have made claims that their diamonds are grown entirely with renewable energy, however the size of their factories and the volume of diamonds they are selling simply do not add up. Many are not declaring they are buying Chinese and Indian grown diamonds.

Currently a lot of LGD marketing is directed towards an alternative to blood or conflict diamonds. That is sad because more than a million people make their living as artisanal miners in Africa and South America.

The summation of the scenario is that LGD’s are trading off a competitor; natural diamonds.

A CVD factory with a lot of high voltage power lines. Image source:

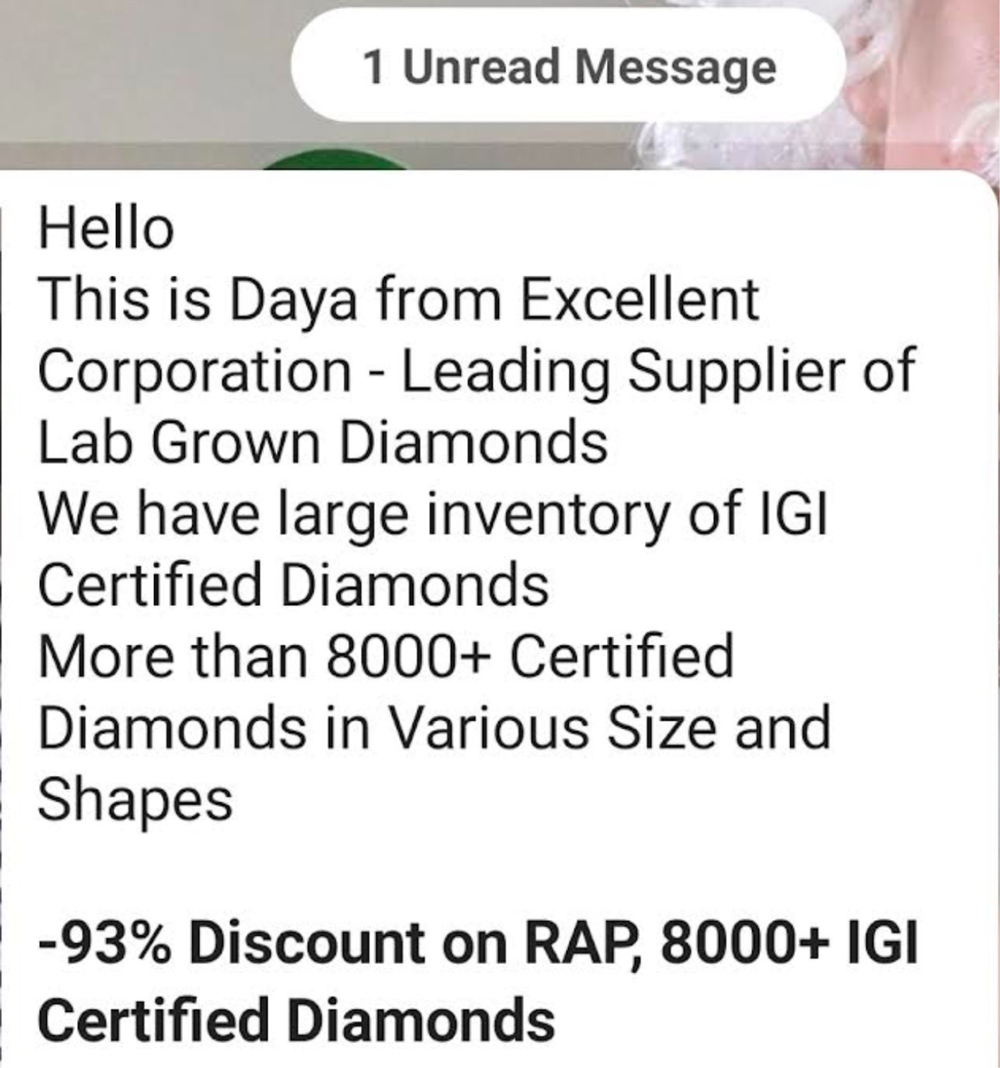

This Whats App message is typical of the race to the bottom with pricing. Dealers joke that soon they will have a negative price i.e. they will be paying people to take them!

LGD Pricing

LGD’s have been marketed and sold on the rarity and quality 4C’s basis of natural diamonds. We’re unaware of any other product that has gotten away with this. The concept is the value LGD’s based on the 4C’s.

Carat Weight: Natural diamonds quadruple in price for a doubling of carat weight. LGD’s should get cheaper as they get heavier in carat weight but they are currently priced the same way as natural diamonds by most wholesalers and retailers. This will change as competition hots up.

Color and Clarity: Currently LGD’s are sent to grading labs and graded with the same criteria as natural diamonds. The Rapaport natural diamond price list is used as the basis for pricing. A few years ago LGD’s were being offered at 50% off the Rap list. Today they are going for less than a third. Let do some arithmetic as an example. Say a natural 1.00ct diamond was $10,000. Three years ago an LGD would have been $5,000 and today it may be $3,000. Does that sound like a bargain? LGD’s are a manufactured product. They have a long way to go to hit the bottom.

Cut Quality: Is far better than the cut of natural diamonds. Most larger LGD’s are grown with the CVD process which makes slabs of diamond. The growth is stopped when the diamond reaches the desired depth for the planned carat weight. Therefore the depth is the constraint. In the case of natural diamonds, most of the time the width of the stone is the constraint so deeper diamonds are most common. Slightly shallower diamonds will always outperform slightly deeper diamonds. This is the main reason that we believe LGD’s will outsell cheaper natural diamonds often sold in chain stores.

De Beers Lightbox LGD’s

Why would De Beers, the second-largest diamond mining company in the world want to compete with itself by making and selling gem-quality LGD’s?

De Beers has been one of the largest manufacturers of synthetic diamonds used as industrial abrasives and many high tech applications. They have a vast array of patents.

Lightbox is a fashion jewelry collection of colorless and bright fancy colored diamonds. The diamonds are priced at $800 per carat irrespective of the carat weight. A 0.10ct diamond costs $80, a 1ct is $800 and a 2ct is $1600.

De Beers guarantee Lightbox diamonds are a minimum of VS clarity and colorless (they define this as G to J, however anecdotally most are G or better).

De Beers aim is to establish man-made diamonds as fun jewellery rather than symbols of lasting love or status as the natural product. In essence an upmarket Cubic Zirconia (CZ).

The factory was sited in a suburb of Portland, Oregon. Oregon’s Columbia River provides most of the electricity and the skilled workforce were obvious reasons to choose Portland. The factory will manufacture 200,000 carats of polished diamonds a year. They will be cut and polished in India.

The jewelry is sold online as well as in US department stores. There are often half-price sales bringing the cost down to $400 per carat.

As LGD production increases they will replace most low-quality ‘not quite right’ looking diamonds in shopping mall jewellers around the world. Some mines will close. Diamond prospectors already struggle for funding. Very few or no new mines will be found to replace aging and closed mines like Australia’s Argyle.

How low can LGD Prices Go?

There are currently three main costs associated with production of LGD’s.

- Cost of growing

- Cost of cutting

- Cost of grading and certifying

The cost of production 2021 is listed in the table left. It is not a surprise that most small diamonds, below half a carat, are being produced using HPHT presses. This is 70 year old technology. Large numbers of small diamonds can be grown at a time, or a single larger stone but at a cost that is not competitive with CVD. CVD, as a newer technology, is not yet as common and requires more trained technicians. The fact that there are currently less suppliers is changing rapidly. The equipment is less costly and available on platforms such as Alibaba. The cost of production for both methods can only continue to fall.

There have been some patent wars as a lot of the CVD technology is protected. As patents expire (they usually provide a monopoly for 15 to 20 years) one cost reduction will be post production treatment. It is common for CVD diamonds to have a brownish color that requires irradiation and heat annealing.

Cutting and polishing should be expected to add less than $100 per carat. Compared to cutting natural diamonds LGD’s require little or no planning and allocation. Deciding how to saw and polish a natural rough diamond to avoid inclusions and maximize the return on a rare and expensive stone is a large cost factor. It is envisaged that a lot of the processes involved in cutting LGD’s will be automated.

GIA charges $125 to grade a one-carat LGD. Over time this may become the single largest cost of a LGD. As competition forces prices down, and companies manage to improve quality, the value of guaranteeing quality will make branding attractive.

The single largest cost factor today is undoubtedly the cost of publicity, promotion and marketing.

Identification

Larger diamonds should always be accompanied by a cert or diamond grading report from a lab. All labs should have the equipment and technicians to safely identify diamonds that have been synthesised.

Various techniques are used and most are based on the fact that 98 to 99% of natural diamonds are type I meaning they have traces of nitrogen. All man-made diamonds are type II. It is very rare for a man-made diamond to be type I. So screening for type is the first step.

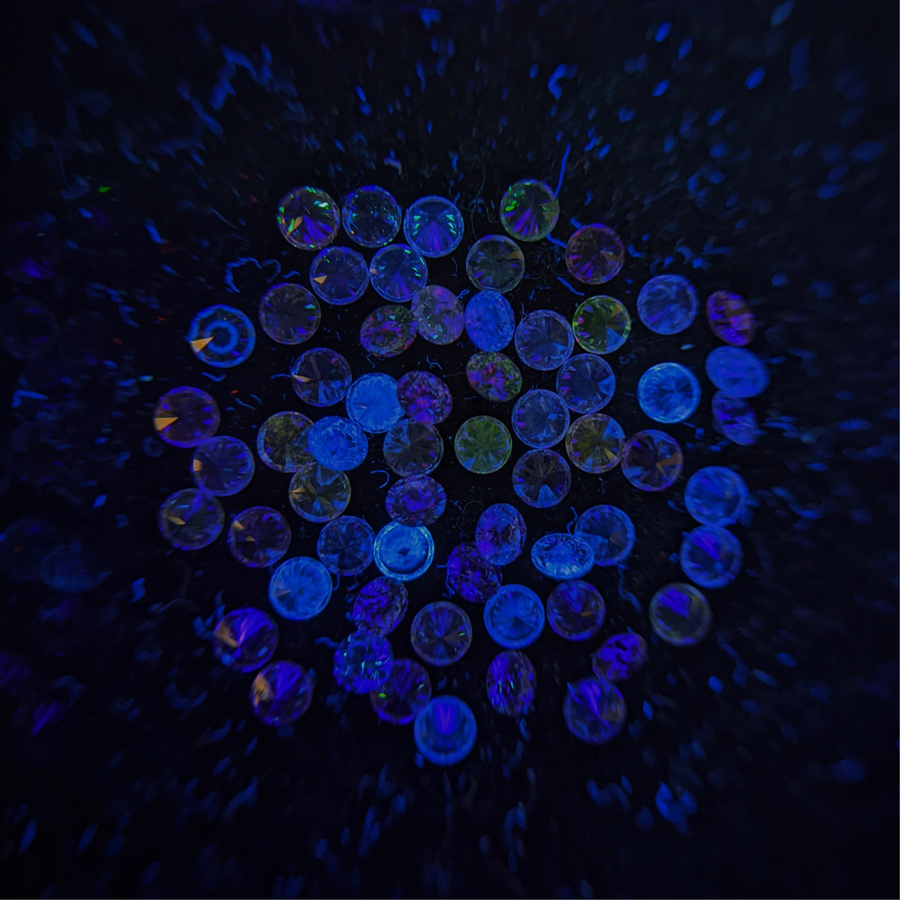

Fluorescence also is used to identify crystal growth patterns using instruments developed and sold by De Beers. There are advanced tests using spectroscopy with the diamond in liquid nitrogen at very low temperatures which GIA and other advanced labs perform on type II diamonds that have passed the De Beers Diamond View™.

When we buy a parcel of smaller diamonds at Holloway we firstly run a very strong magnet over the diamonds. Most small synthetic diamonds are made using an HPHT press with diamonds grown in a magnetic metallic melt. Inclusions are often magnetic whereas natural diamonds never are. If even one of a parcel of hundreds is magnetic we will never deal with that vendor again. Next, we check for fluorescence and phosphorescence in a device made by John Chapman in Perth. If more than a few percent of the diamonds prove to be type II then we expect the parcel has been seeded with some synthetic diamonds.

Industrial Diamonds

If you google industrial diamonds you will be amazed at their applications. Everything from dental drills to quantum computing.

There is a bit more than 100 million carats of natural gem diamonds mined each year. More than 22 ton. Miners sell them for about $15 billion so the average value per carat is only $150. Yes, most natural diamonds don’t cost much. Clearly most of them are really poor quality. The Pareto principle dictates that 80% of the value is the rare 20% of best quality.

By comparison there is around 15 billion carats of synthetic industrial diamond produced each year, that’s 150 times more than all the mined diamonds! They average about $1 per carat. They are worth more than mined industrial diamonds because they are made to order. You want sharp pointy ones for abrasives? You want flat see through ones for windows to watch high pressure chemical reactions?

The main manufacturing nations are China, France, Ireland, Japan, Russia, South Africa, Sweden, and the United States. Most of that production by volume is HPHT and is a mature industry, hence HPHT diamond press technology has been well developed over several decades. The presses are expensive because they weigh upto 100 ton of steel. Repurposing a press, or a factory full of them, to make gem diamonds is viable.

CVD on the other hand is a relatively new technology first investigated in the 1980’s and developed primarily to manufacture type II slabs of diamond as heat sinks to take heat away from computer chips. Computers used in missiles for example need to be very small so they can process information very fast. That creates a lot of heat and type II diamonds conduct heat 50% faster than type I diamonds which is five times more than silver, the most thermally conductive metal. All synthetic diamonds are type II. As the technology progressed it became commercially viable for gem diamonds around decade ago.